ESG Metrics are critical for enterprises to assess their ecological, social, and administration matters.

Explanation of Environmental, Social, And Governance (ESG)

ESG (Environmental, Social, And Governance) is a unique set of principles in an organization’s operations that investors, including Bill Gates, utilize to monitor a potential investment.

The environmental basis examines the organization’s performance, while the social cause explores how it oversees interrelation with:

- Workers

- Clients

- Suppliers, and

- The surrounding community

Governance deals with:

- Organizational management

- Directorial payment

- Audits

- Investors’ rights, and

- Central control

Key Takeaways:

- ESG is a popular evaluation technique that guides investors on which company they want to invest in.

- Numerous organizations, including brokerage companies and mutual funds, offer products that utilize its basis and enable them to realize the ESG metrics meaning.

- ESG helps investors avoid companies that can present a significant financial risk due to various practices.

If you can’t measure it, you can’t manage it.

The Main Components of ESG

There are three critical parts to ESG investing:

1. Environmental

The environmental basis includes how the organization uses its energy, waste, conservation of natural resources, and how it treats animals, if any are used in the organization. In addition, the basis assists in evaluating the ecological risk that an organization might encounter and effective ways to manage such risks.

2. Social

The social component of ESG plays an essential role in controlling the organization’s relationships. It ensures that workers have safe working conditions, stakeholders’ interests are looked after, and the surrounding communities benefit from the organization’s presence.

3. Governance

Governance plays a crucial role in ensuring the organization is transparent and ethical in its operations. As a result, investors can confidently invest in the company.

A number of important metrics are used to evaluate ESG. The best way for leaders to keep a finger on the pulse of these vital metrics is to track them using a KPI board. Profit.co’s OKR Management platform enables users to create custom KPI boards to collect their top KPIs and metrics on one easy-to-access screen. You can get started on Profit.co for free today and check out how this powerful tool can help you transparently track your top metrics!

Why Are ESG Metrics Vital To A Business?

- ESG metrics assist you in measuring the performance of three critical sectors that affect the entire globe

- It enables the investors to pin down distinct threats and risks before investing in a project

- The analysis assists the investors in determining the company that will have an excellent return on investment in the end

- Investors use the data to determine the company’s risk factors that might adversely affect the environment

- Accident records

- Safety arrangements, and

- The assessment of the company’s working conditions

-

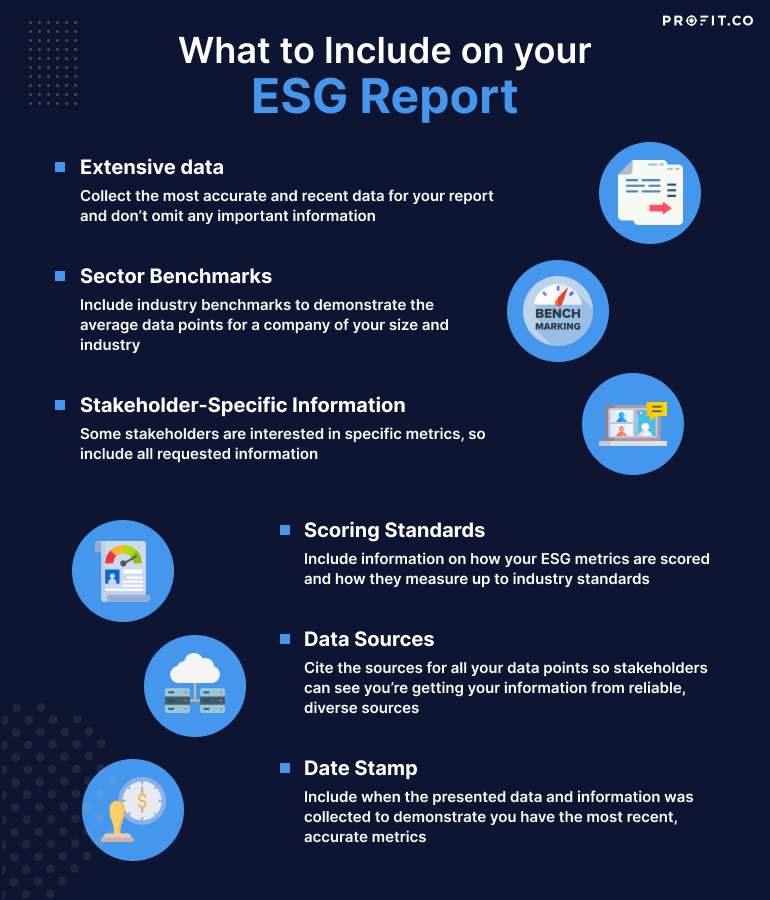

Extensive data:

Your report benefits from referencing factual data. You can opt to offer some of it voluntarily, however, state declaration policies can provide direction for releasing other data. Depending on your company’s industry, you can determine the most relevant ESG factors.

-

Sector benchmarks:

Sector benchmarks dictate the acceptable ESG standards in a specific industry and scrutinize how every company compares to the average.

-

The stakeholder-specific data:

This feature highlights the details specific stakeholders would like to see in a given project. This not only gives stakeholders what they need to be fully informed, but it also highlights their opinion on various ESG subject matters and what they find most important.

-

The scoring standards:

The feature illustrates how to achieve ESG metrics against the sector standard.

-

Data sources:

It’s important to collect data from various sources and adhere to the most accurate reporting methods when creating a report so you can verify critical data during calculation.

-

Date stamp to ensure timely reporting:

Data reports and information should be up-to-date so that you can have the most recent and helpful information on the development of ESG factors and metrics.

- Partners

- Clients

- Stakeholders

- Investors

7 Popular ESG Metrics and Components

Some ESG metrics are more essential than others to investors and business as a whole. While some companies use a set of ESG metrics on a regular basis, another company in a different location or industry might have an entirely different set that they use.

Some metrics and activities are relatively easy to measure and appear on the reports often, regardless of industry. These includes:

1. The Overall ESG Policy

The metric plays an influential role in recapping the organization’s adherence to social responsibility and its place in ecological concerns. Organizations measure how closely they stick to their policy and where they are falling short. An organization that strictly adheres to their set ESG policy is more attractive to investors.

2. The ESG Responsibility Assignments

The metric indicates the names of people in charge of the management team who serve various situations. This metrics tracks an activity more than a data point, and holds individual employees and leaders accountable for their actions and their deliverables regarding the ESG criteria of their organization.

3. The Collective Ethical Codes

The metric guides employees and the entire management team in conducting themselves per the organization’s policies and values. This information demonstrates the dedication and the integrity of the members of an organization.

4. The Management, Employees, and Members of the Board Have Diverse Information

The metric has the data of diverseness within an organization and the procedures set up to boost the varied and comprehensive work environment. Investors want to see that an organization is looking at various sources of information to confirm that they’re in a good position regarding ESG criteria. So, this is important information to track.

5. The Environmental Policy

This metric examines the effects of the company on the environment. In addition, it explores how the leadership team deals with this critical issue.

6. The Carbon Discharge Evaluation

This metric is responsible for estimating a company’s carbon discharge during supply chain operations. It includes manufacturing, acquiring resources, and shipping operations.

7. Health and Protection Data

These metrics include;

What Does an ESG Report Entail?

Organizations and investors utilize various factors to monitor and improve ESG metrics. Every business can use a combination of metrics while creating presentations and reports.

Below are some of the standard features that are pretty easy to compare to help analyze performance.

The Process of Implementing ESG Reporting, Metrics, and Measurement

If you wish to start reporting on ESG metrics in your company, follow the steps below:

1. Establish ownership and support

Designate a certain individual to own ESG reporting and ensure they get support from executives, investors, and board members. Ownership of an objective, goal, metric, or target, can drastically increase the likelihood that it will be achieved.

2. Develop the ESG team

Put together a team that will assist you in establishing the metrics and reports. This can be a group of volunteers or assigned individuals. Regardless, it’s essential to include a sponsor and executive manager who assist in making connections across the organization and help lead the team.

3. Determine what to measure

Determine the most important metrics for your company to track. In addition, look for things that your partners, investors, and employees require you to prioritize.

4. Create a framework and determine which ESG details to report

The framework and format of an ESG report will differ from one company to another based on the industry and size. So, it is vital to decide on the framework that you will utilize and make a public report. In addition, you may opt to combine numerous frameworks and use them together.

5. Establish your intent and a direction

Utilizing the suggestions that you select from the frameworks, you can find the guideline for your key metrics. Then, use the framework’s guidance, corporate social responsibility from the competitors, and point out your target.

6. Use ESG targets to determine executive & board compensation & evaluation

This can be a time-consuming and difficult task to complete, however, linking executive and board compensation and evaluations to ESG targets can help ensure that the company’s leadership is dedicated to the improvement of ESG metrics.

7. Consolidate the ESG reporting in the business

With the assistance of the ESG team, identify the sources of all your ESG data and metrics and create a web of alignment and communication flow to ensure that all data is transparently available to the necessary stakeholders and it can easily be consolidated.

8. Automate data collection and reporting for real-time reports

Use a software or tool to automate the collection of necessary data and produce custom reports to make receiving and distributing the metric information easier. Partner with the HR, marketing, sales, and branding teams to pinpoint how ESG metrics are beneficial to others in the business. Tell them about the progress and some of the achievements. Also, ensure that the improvement process is transparent to;

Bottom-Line

Businesses of all sizes must prioritize ESG metrics since ESG has long-term and short-term benefits. In addition, the company must always be up to date to make it easy to access ESG data for their employees, investors, and leaders.

Accessing timely information on the ESG performance creates a healthy relationship with the investors. In order to provide this data, you have to be able to track your most important ESG-related activities and metrics. Profit.co’s OKR Management platform has agile, customizable features that can help you and your team keep a finger on the pulse of important ESG factors and improve your standing. To learn more about Profit.co’s business management tool, schedule a free demo!