TL;DR

Cognitive biases can quietly undermine project portfolio decisions, leading organizations to pick the wrong projects and waste resources. Common issues include optimism bias, confirmation bias, and political pressure. To address this, use structured decision processes, promote independent reviews, and build a culture where questioning assumptions is encouraged.Many of us have experienced an executive meeting where everyone agrees on a new project. The budget seems manageable, and the timeline looks challenging but possible. Six months later, costs have doubled, deadlines are missed, and the expected benefits are nowhere to be found. What went wrong? The answer may be surprising, but it is actually quite common. Research shows that cognitive and behavioral biases often distort project portfolio decisions, leading organizations to repeatedly choose the wrong projects and mismanage their portfolios. This affects how billions of dollars are spent across industries.

“We have a habit of distorting the facts until they become bearable for our own views.”

Let’s see why this happens and what you can do about it.

The Invisible Bias Triggers in Your Boardroom

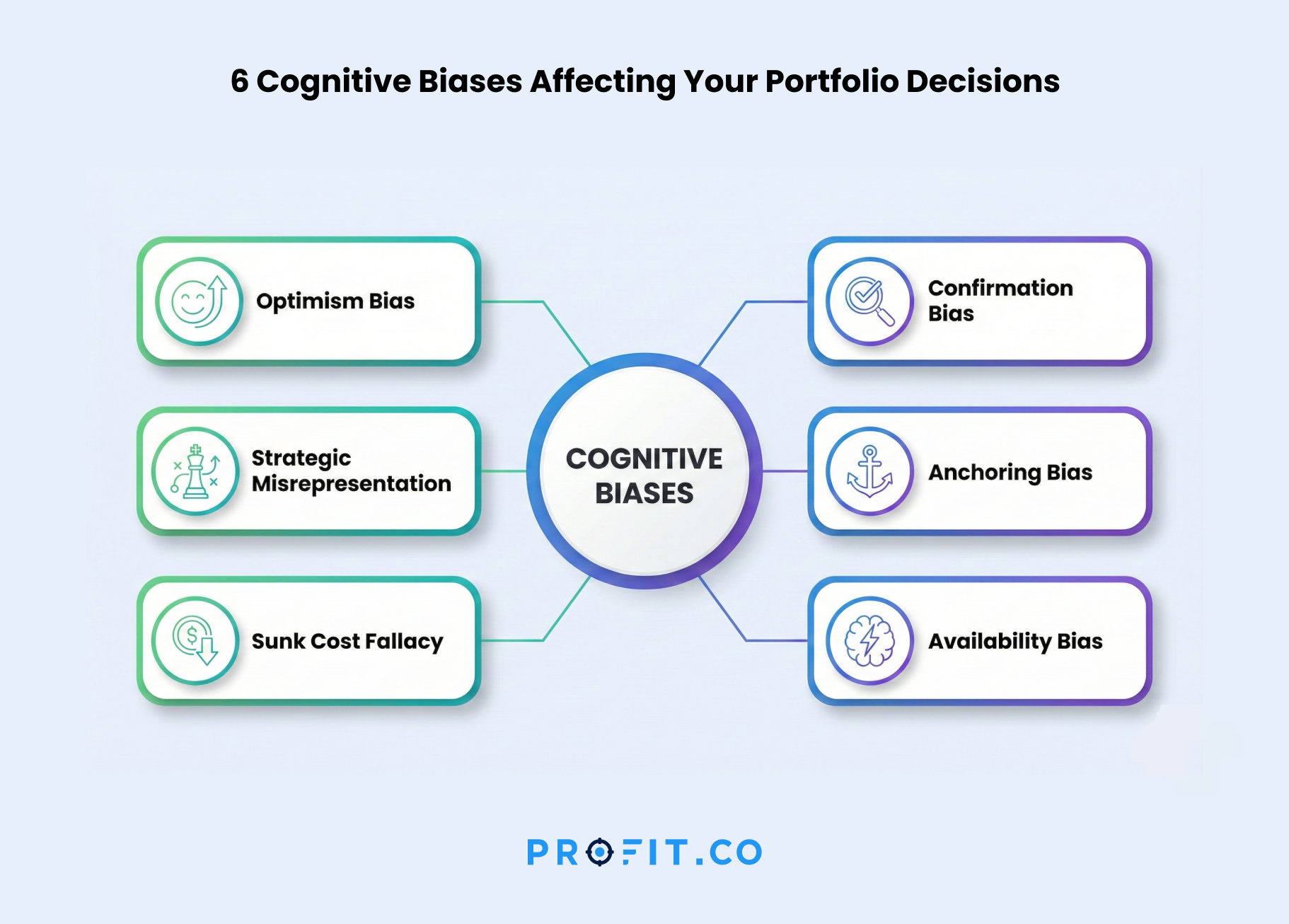

The uncomfortable truth is that our brains can work against us, not on purpose, but in predictable ways. Behavioral science has found over 200 cognitive biases that influence decision-making, and some are especially harmful in project portfolio management.Optimism Bias: The Rose-Colored Glasses Effect

Every project champion always believes their project is different. That their timelines are realistic, their budget is more accurate, and their risks are manageable. That’s optimism bias.Many studies show that project managers often underestimate costs and timelines while overestimating benefits. Research has found that large projects most often have cost overruns. These overruns rarely bring extra benefits. Most projects end up with higher costs and lower benefits.

Strategic Misrepresentation: When Politics Trumps

Sometimes the issue is not just unconscious bias, but intentional distortion. Project champions may realize their project will not get approved with realistic numbers, so they adjust the data. They report lower costs, higher benefits, and minimize risks. Why? Because that’s what gets projects funded.This creates a vicious cycle. Organizations reward optimistic proposals, which encourages more optimism, which leads to more failures, which should discourage optimism, but somehow doesn’t. The incentive structure is broken, and everyone knows it, but changing it feels impossible.

The Sunk Cost Trap: Throwing Good Money After Bad

We’ve all seen it. A project is clearly failing. The warning signs are everywhere. But instead of cutting losses, the organization doubles down. Why? Because we’ve already invested so much.This is known as the sunk cost fallacy, and it is one of the most costly biases in portfolio management. Previous investments should not affect future decisions, but they often do. We feel the need to justify earlier choices, even if it means wasting more resources.

Confirmation Bias: Seeing What We Want to See

Once we’ve committed to a project, we filter information. We focus on data that supports our decision and ignore or dismiss evidence that contradicts it. This is not intentional; our brains simply filter out the opposing evidence and fail to catch problems early. Everyone involved has already decided that the project is worthwhile, so they unconsciously interpret ambiguous data in a favorable light.The Real Cost of Biased Decisions

Poor portfolio decisions don’t just affect individual projects alone; they compound across your entire organization.When you select Project A over Project B based on overly optimistic projections, you’re not just getting a mediocre project. You’re missing out on the superior returns Project B would have delivered. When you continue funding Project C despite clear warning signs, you’re not just wasting money on that project; you’re preventing better opportunities from getting the resources they need.

This is not just about individual mistakes. It is about ongoing distortions that influence decisions repeatedly, across many projects and over many years. The combined effect can be enormous.

Where Bias Shows Up Most in Portfolio Decisions

Bias doesn’t appear randomly. It concentrates on three specific portfolio moments, and if you know where to look, you can catch it before it becomes expensive.1. Idea selection

This is where the portfolio’s direction is quietly set. Early-stage ideas compete for attention, and the loudest voice, trendiest initiative, or most charismatic sponsor often wins. Bias at this stage leads to crowded roadmaps, scattered bets, and “pet projects” entering the pipeline without real strategic value2. Business case review

Once an idea moves forward, the business case becomes the gatekeeper. But this is also where optimism bias and strategic misrepresentation thrive. Forecasts get cleaned up to look safer, benefits get inflated to sound compelling, and risks are softened to avoid rejection. If the business case is biased, the portfolio is biased by default.3. Stop/continue calls

This is the hardest moment for leaders. Even when evidence shows a project is failing, the pressure to “protect past investment” keeps money flowing. Teams justify continuation to avoid admitting mistakes, and leadership hesitates to cut losses. The result is a portfolio clogged with low-return work that blocks better opportunities.These three moments shape what gets approved, what gets funded, and what keeps consuming resources. Fixing bias here is the fastest path to improving portfolio quality overall.

Practical Solutions That Actually Work

Once you recognize these biases, you can set up systems to reduce their impact. Here are some strategies that top organizations use to make better portfolio decisions:Move Beyond Informal Decisions

Create explicit frameworks that require documenting assumptions, evidence, and reasoning. When people must articulate their logic, hidden biases become visible. Use standard templates for project proposals and need specific data points. This makes it easier to compare projects by using consistent evaluation criteria.Embrace the Devil’s Advocate

Assign someone the clear role of challenging assumptions. Their goal is not to be difficult, but to bring up evidence that may contradict the main view. Their job is to ask tough questions:- What if costs are 50% higher than projected?

- What evidence suggests this timeline is realistic?

- What would need to be true for this project to fail?

The important thing is to make this challenge a normal and accepted part of the process, not a source of conflict.

Demand Independent Estimates

Do not depend on just one estimate, especially if it comes from the project champion. Ask for several independent assessments. Involve people who have no personal interest in whether the project is approved.Third-party consultants can be very helpful in this situation. They do not have political reasons to change the data and can offer neutral, data-based analysis using similar projects as a reference.

Use Reference Class Forecasting

Rather than relying on bottom-up estimates, which tend to be optimistic, use statistical data from similar past projects. If similar projects usually go 27% over budget and take 40% longer than planned, assume yours will too unless you have clear, documented reasons to expect a different outcome. This method dramatically improves forecast accuracy by basing estimates on real data instead of optimistic guesses.Create Psychological Safety for Bad News

If people fear punishment for admitting problems or changing direction, they will hide issues until they become serious. Leaders should reward early reporting of problems and support decisions to stop failing projects.Conduct Rigorous Post-Mortems

After projects finish or fail, review what happened and why. Identify where estimates were off, which assumptions were incorrect, and what biases affected decisions. The goal is learning. Share these insights across the organization so everyone learns from each project’s experience.Changing the Culture, Not Just the Process

The most important point is that changing processes alone will not fix the bias problem. Cultural change is also necessary. Organizations should move from rewarding optimism to rewarding realism, from punishing mistakes to learning from them, and from political maneuvering to making decisions based on data. This is not easy. It takes real commitment from leaders. Executives need to set an example by accepting challenges to their own projects and supporting decisions to stop failing initiatives.The Path Forward

Cognitive biases will always be part of how people think. However, this does not mean we cannot do anything about them. The best organizations create systems to reduce their effects. They create checks and balances. They demand independent verification. They reward intellectual honesty over political skill. They make it safe to challenge assumptions and change course. Your organization is likely leaving significant value on the table right now because of these biases. The question is, what are you going to do about it?Ready to improve your portfolio decision-making?

There’s a crucial difference between motivation and forecasting. Be optimistic about execution while being realistic about planning. Research shows that realistic forecasts lead to better project outcomes because teams prepare properly for challenges rather than being blindsided by “unexpected” problems that were actually quite predictable.

Look at historical performance. Compare initial project estimates to actual outcomes. If your projects consistently run over budget, take longer than planned, or deliver fewer benefits than promised, bias is affecting your decisions. The pattern reveals the problem.

Initially, yes. But consider the cost of quick, biased decisions: failed projects, wasted resources, and missed opportunities. The time invested in better upfront analysis is tiny compared to the cost of selecting and executing the wrong projects. Speed without accuracy is just expensive failure.

Resistance is common because these processes expose overly optimistic projections. The solution is changing incentives. Reward champions for realistic estimates that prove accurate, not optimistic ones that gain approval. Celebrate transparency, not salesmanship.

Absolutely. Start simple: require documented assumptions, appoint a designated challenger for major decisions, and conduct basic post-mortems. These cost almost nothing but significantly improve decision quality. Scale up as you see results.

You’ll see better decisions immediately, but portfolio-level results take time. As new projects selected with better processes replace older, bias-influenced projects, overall portfolio performance improves. Most organizations see measurable improvement within 12-18 months

Related Articles

-

Why Do People Break Promises? The Psychology Behind the Say-Do Ratio

Organizations and individuals rarely fail because of poor intentions; they fail in the space between commitment and execution. The say-do... Read more

-

Why Leading by Example is the Most Powerful Leadership Tool

Here’s a little secret about leadership and not the kind you read in thick business books or hear about in... Read more

-

Understanding Impostor Syndrome: The What, Why, and How to Beat It

Ever feel like you’re just pretending to be good at your job and any minute now, someone’s going to find... Read more

-

How a Traditional Coffee Ritual Transformed Employee Engagement

Sasi Dharan Global Marketing Head – Profit.co Last updated: June 23, 2025 An Indian company is on the rise, and... Read more