Profit.co Integrations sync your favorite apps to create seamless, unified collaboration Read more about Profit.co integrations

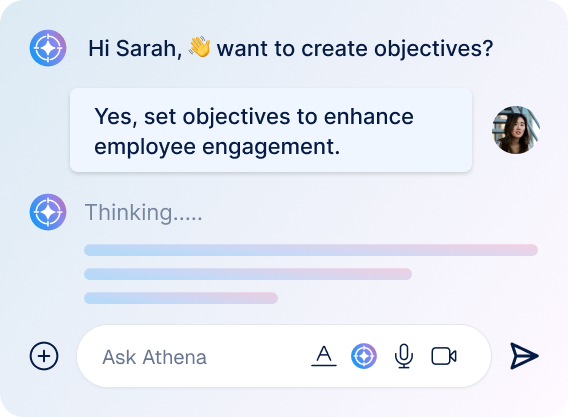

Profit.co AI Agent, your intelligent strategy assistant for smarter, faster decisionsRead more about AI Agents

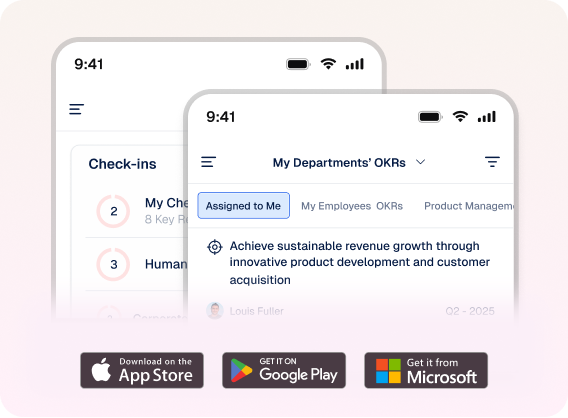

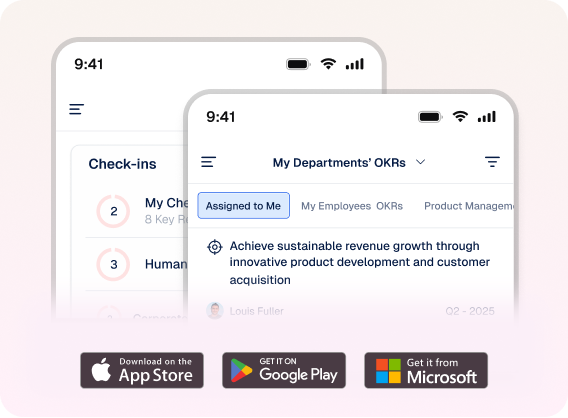

Profit.co Mobile App, stay connected and productive from anywhere you work.Read more about Answers

Profit.co Integrations sync your favorite apps to create seamless, unified collaboration Read more about Profit.co integrations

Profit.co AI Agent, your intelligent strategy assistant for smarter, faster decisionsRead more about AI Agents

Profit.co Mobile App, stay connected and productive from anywhere you work.Read more about Answers